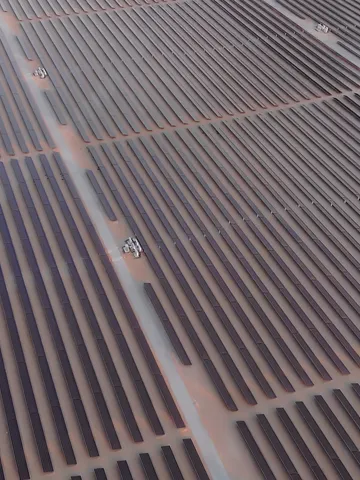

Tunisia's Ministry of Industry, Mines & Energy has launched a tender for a 300MW solar and 150MW/540MWh battery storage project at Bazma in the Kebili governance under a PPP structure.

Lead Story

Lead Stories

The renewables market has been waiting on new tax rules on foreign entities. A newly issued notice is now being unpacked. By Alison Healey

Aquila Clean Energy is seeking battery storage funding in South Australia. The developer is building out generation assets as well. By Alexandra Dockreay

The first large-scale SAF project has been financed. More are to follow but hurdles remain. By Rod Morrison.

PFI Comment

The concept of squeezing financial structures to the nearest basis point or equity percentage has moved into a much wider universe. Standalone project financings are still in the market, but many deals are now backed by portfolio structures and leverage ratios. The search for yield has moved into the higher risk sub-investment-grade space with lenders protected by equity, hopefully.

The lunar year of the fire horse is here and Eastern Europe is set to ride it with commercial debt in the project finance hot seat. A strong start in Romania puts the region on the radar for a promising season. By Cristiana Sandeva.

New leadership, new markets and a UK launch in sight. How EDF-Morrison’s joint EV platform is positioning itself for Europe’s next phase of electrification. By Hassan Butt.

PFI Global Energy Report 2025

PFI Global Energy Report 2025

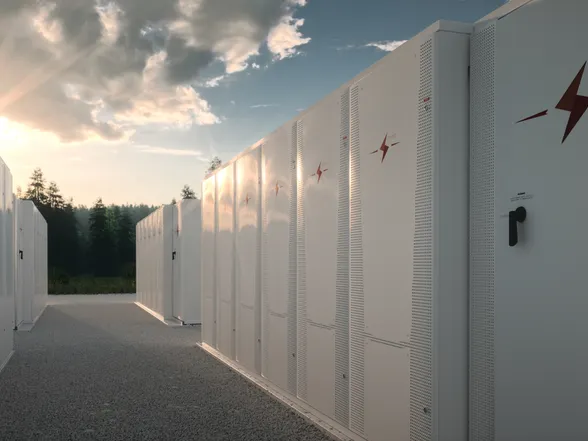

PFI has published its annual Global Energy Report. The report presents case studies of important leading-edge deals and profiles various institutions and developers involved in the sector. Battery storage is a common theme across the report alongside energy for AI and data centres.