Project Lightning, the US$3.8bn project to construct the first high voltage direct current (HVDC) subsea transmission cables in the Middle East and North Africa (MENA), has an ambitious goal. By Julien Bocobza, Joanne Emerson Taqi, Ashleigh Petzer and Kevin Lee, White & Case.

ADNOC currently generates electricity for these operations through gas-powered turbines that are nearing the end of their design life. Two 600MW 150km sub-sea HVDC transmission links (main and redundant) with onshore and offshore HVDC converter stations – the Ruwais HVAC 400KV substation and the Das Island HVAC substation – will be constructed to connect Abu Dhabi National Energy Company’s (TAQA's) onshore power network to the Abu Dhabi National Oil Company’s (ADNOC's) offshore operations located on Al Ghallan and Das Islands.

Similarly, two 1,000MW 134km HVDC cables and associated converters will connect the Al Mirfa HVAC substation to an HVAC substation built on an artificial island close to Al Ghallan Island. Total power transmitted will be 3,200MW and with that capacity the two HVDC links will be by far the most powerful power-from-shore solution in the MENA region.

This innovative project will power ADNOC’s offshore production operations with cleaner and more efficient energy, reducing the carbon footprint of ADNOC’s offshore operations by more than 30% – no small feat in the global push to drastically reduce carbon emissions. In addition, the project also offers potential for ADNOC to more effectively utilise its rich gas – currently used to power the offshore facilities – for higher value-purposes, allowing ADNOC to generate additional revenues for ADNOC and for Abu Dhabi.

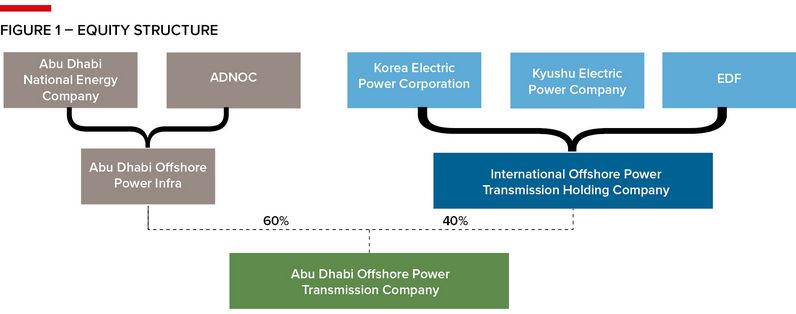

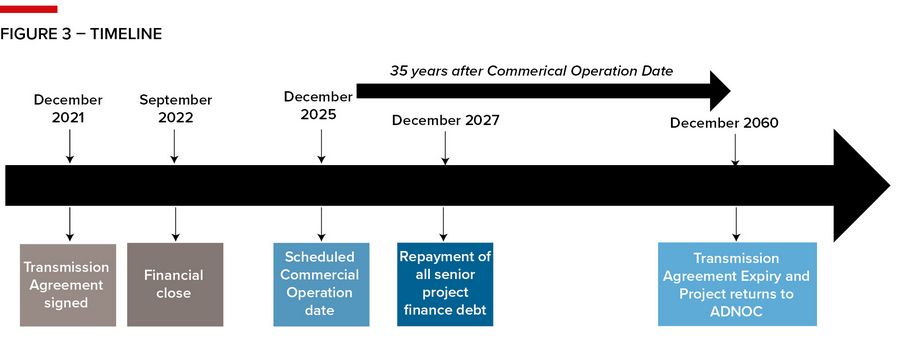

Project Lightning was announced, awarded and progressed to financial close in two and a half years – an impressive effort by both the state procurer and the winning consortium comprising Korea Electric Power Corporation (KEPCO), Japan’s Kyushu Electric Power Co (Kyushu) and Electricite de France (EDF). Led by KEPCO, the consortium is holding a combined 40% stake in the project, with ADNOC and TAQA holding 30% each. A diagram of the project structure is shown in Figure 1.

The consortium will develop and operate the state-of-the-art transmission system alongside ADNOC and TAQA on a build, own, operate and transfer basis, with the full project to be returned to ADNOC following the 35-year operation period.

The EPC contract was awarded to a consortium of Samsung C&T and Jan de Nul Group, while the OEMs selected for the project are Hitachi Energy with respect to the converter stations, and Sumitomo Electric and Prysmian Group with respect to the HVDC cable for Das Island and Al Ghallan island, respectively.

Financing plan

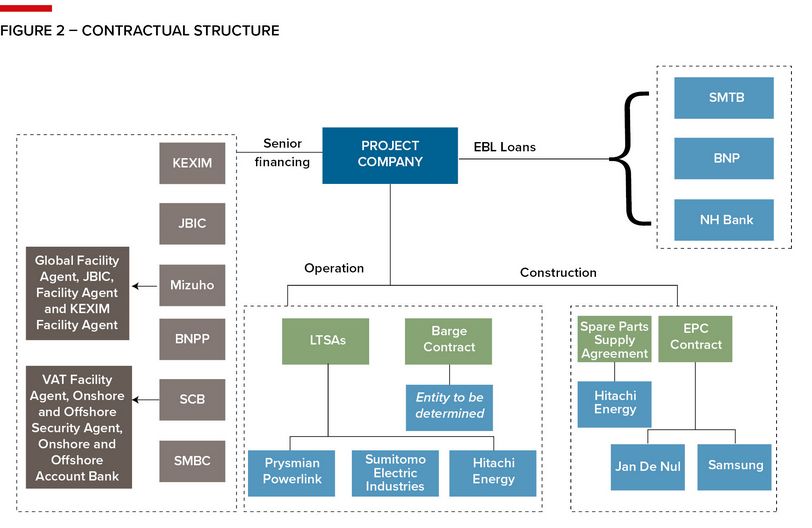

The total cost of Project Lightning is financed by a mix of approximately US$3.2bn in senior project finance debt and approximately US$720m in equity bridge loans. Similar to the structuring of other project financings in the region, the sponsors were required to utilise the entire base equity prior to the drawdown of senior debt. A diagram of the financing structure is shown in Figure 2.

Given the sheer scale and cost of the project, the project would not have been developed without support from export credit financiers. In this case, the Export-Import Bank of Korea (KEXIM) and Japan Bank for International Cooperation (JBIC) collectively provided approximately 75%, US$2.4bn, of the senior project finance debt.

There can be no doubt that JBIC and KEXIM’s involvement was also intended to underpin and further strengthen trade relations between Japan, South Korea and the United Arab Emirates, particularly at a time when energy security and energy transition are at the forefront of the agenda.

The commercial banks rounding out the financing comprised Mizuho Bank, Sumitomo Mitsui Banking Corporation, BNP Paribas and Standard Chartered Bank. SMBC also acted as financial adviser to the consortium. Mizuho also acted as the global facility agent, JBIC as the facility agent and KEXIM as the facility agent, and Standard Chartered Bank acted as VAT facility agent, and onshore and offshore security agent as well as onshore and offshore account bank.

All equity bridge loans are scheduled to be repaid in full on or near the scheduled commercial operation date of the project at year-end 2025.

The senior debt has been structured on a hard mini-perm basis with a 5.5-year tenor from first drawdown with a balloon repayment in December 2027. ADNOC and TAQA mitigated the refinancing risk by committing to providing a revenue tariff adjustment at the time of refinancing. This structure enabled the consortium to make best use of short-term loan pricing which proved more competitive than an equivalent long term amortising structure or even the traditional soft mini-perm structure that has historically been popular in other projects in the region.

This structure potentially paves the way for a long-dated project bond take-out, which would make use of different liquidity sources once the project is operational.. Based on publicly available information, we understand that this is only the second hard mini-perm structure used in Abu Dhabi for project financing and the first one for JBIC.

One major and unexpected challenge on the overall project economics was the sharp and sudden global rise in interest rates in the run-up to financial close, which occurred in September 2022. At the time of the bid by the successful consortium in November 2020, no one could have foreseen the drastic rise in interest rates caused by central banks across the board tightening monetary policy in response to inflationary pressures.

When the interest rates were fixed at financial close, the overall financing costs of the project had increased dramatically, causing additional debt and equity to be injected into the project.

Beyond the sharp rise in interest rates, Project Lightning also had several unique challenges that were successfully overcome through strong collaboration between all parties.

* Covid-19 – ADNOC started the tender process for the project in April 2020, just as the Covid-19 pandemic was affecting business travel and resourcing. As a result of these issues, negotiation and finalisation of the first round of key project documents and financing term-sheets were completed almost entirely virtually. All parties quickly adapted to the online process, however, given the complexity of the documents, as well as the numerous stakeholders and advisers who were involved in the process to achieve both commercial and financial close, this was a challenging phase of the project for all involved.

* First of a kind project financing – Unlike IPPs or pipeline projects, there is no precedent documentation for subsea transmission projects and all stakeholders had to work together to draft and negotiate bespoke project and financing documents for the project. In addition, we also understand that this was ADNOC’s first greenfield project financing. This was only made possible thanks to a suite of robust bid documents, including the transmission agreement and EPC contract, both of which were prepared by ADNOC and its advisers, and the innovative approach taken by each stakeholder (whether the contractors, the lenders or the shareholders).

* Insurance market – Subsea cable projects involve a complex set of risks that invariably result in lengthy discussions with insurance brokers, insurers and reinsurers. Project Lightning was no different. These discussions were particularly challenging given the current volatility of the global insurance market and the corresponding difficulties of costing insurance premiums and negotiating deductibles in the period between bid phase and financial close.

* Availability – Repairing subsea cables quickly and efficiently is a critical aspect of the project and an important KPI for the project company. Unsurprisingly, ADNOC maintained a high availability requirement for the project, which was achieved through the joint commitments of the consortium members and the cable OEMs engaged under long-term service agreements, and the innovative use of dedicated O&M resources such as special tools and barges.

* Environmental – The potential impact of the project, particularly the laying and location of the subsea cables themselves, on the surrounding environment (which includes a natural marine reserve), was a key issue for all stakeholders. Using best practices, the consortium obtained an environmental and social due diligence report to demonstrate the project’s commitment to, and compliance with, the Equator Principles 4 and the International Finance Corporation Performance Standards. Extensive environmental studies were also undertaken, and the cables were required to follow a pre-agreed corridor to ensure environmental protection. Strict environmental reporting procedures were also implemented to satisfy stakeholders' concerns about the impact of the project on the environment.

* Local content – It was an essential criterion for both ADNOC and the consortium that the project was embedded in the local UAE economy and that local content was at the heart of the value proposition for the project. More than 50% of the project value will flow back into the UAE’s economy under ADNOC’s In-Country Value (ICV) programme. This was a realisation of the consortium’s commitment to the local economy and ensures long-term private sector commitment for the UAE.

* Libor transition – Due to the rather extended period between bid stage and financial close, the bid was structured on a Libor basis while the final transaction closed on a SOFR basis, with accompanying adjustments in interest rates and the financing structure.

* Limited notice to proceed – In order to mitigate any potential delay to the project execution between bid submission and financial close, the consortium issued a limited notice to proceed to the EPC contractor as soon as the transmission agreement was executed. This allowed the EPC contractor to commence certain early works including design and ordering of long lead items and for the parties to preserve the agreed date for commercial operation of the project.

Looking ahead

Project Lightning is a significant environmental milestone for ADNOC and the UAE, which recently unveiled its Net Zero by 2050 Pathway at the 27th UN Climate Change Conference. Carbon-neutrality commitments, technological advances, and improved cost incentives are accelerating a broad expansion of renewable power generation.

HVDC cables transmit renewable power with low losses over a longer distance to regions of consumption and thereby assist to decarbonise the power and energy system, and support the resilience and reliability of inter-connected HVAC/DC transmission grids.

In a world that is increasingly seeking solutions to address greenhouse gas emissions, HVDC transmission cables can play a central role in achieving a cleaner, sustainable and affordable energy mix available to all and Project Lightning will go a long way to demonstrate the important role HVDC transmission cables can play in the race to achieving energy transition objectives globally.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com