The US$580m 500MW Zarafshan Wind IPP by Masdar reached financial close in November this year with the backing of five development finance institutions and two commercial lenders, thus setting a significant milestone for the country’s infrastructure development and decarbonisation. By Yusuf Macun, managing partner, and Nick Sinden, executive director, Cranmore Partners.

Since Masdar, the renewable energy developer owned by the Abu Dhabi Government, started construction of the 100MW Nur Navoi Solar PV project – the first PPP and IPP in Uzbekistan – in December 2020, the country has continued to be a source of opportunities for international developers, lenders and advisers, as the government accelerates its infrastructure development programme.

Decarbonising the power sector

The development of the Zarafshan Wind IPP is part of the wider decarbonisation strategy of the Uzbek government. At the end of 2020, the 15.9GW of installed power capacity in the country was dominated by 13.9GW of thermal and 2.0GW of hydro, with no wind or solar at all on the grid. In the same year, out of total electricity generation of 66.5TWh, 88% came from gas-fired plants powered by Uzbekistan’s domestic natural gas supplies – source, IEA.

To start decarbonising its power generation, the government announced in 2019 a target of 25% from renewables by 2030. This strategy was further strengthened with the release of its “Energy Supply Security Concept 2020-2030” in April 2020, targeting 8GW of renewables – 3GW of wind and 5GW of solar – to come on stream by 2030. In 2022, these targets were further upgraded; with 8GW to be in place by 2026, and a further 4GW by 2030 – a total of 12GW, of which 5GW would be wind and 7GW solar. As the first wind IPP to close in Uzbekistan, Zarafshan thus sets the benchmark for extensive future wind developments in the country.

Zarafshan’s long road

Masdar’s involvement with Uzbekistan goes back to the first Scaling Solar project, Nur Navoi, where the government, supported by IFC, issued a tender for 100MW of solar PV. Masdar was successful against four other bidders, with a winning tariff of USc 2.679/kWh. The 20-year power purchase agreement (PPA) was signed in November 2019 and financial close reached in December 2020 despite Covid being in full swing. The plant was inaugurated on August 31 2021 – the first utility scale IPP and PPP in the country.

In the meantime, in order to accelerate progress towards its renewable targets in parallel to its multiple tenders, the government has negotiated the framework for Zarafshan with Masdar, under a government-to-government engagement with the UAE. On March 20 2019, Masdar signed a Joint Development Agreement with JSC National Electric Grid of Uzbekistan (NEGU) and the Ministry for Investment & Foreign Trade of the Republic of Uzbekistan (MIFT) to develop a 500MW wind farm portfolio, with Zarafshan in the centre of the country identified as the site of the first project. Through further discussions this became a single 500MW site. A PPA and investment agreement were negotiated around this concept and signed on June 10 2020. The PPA has a 25-year term with a non-indexed tariff, and broadly follows the Nur Navoi precedent, adapted where appropriate to the specifics of a wind IPP.

The US$580m project is located in the Navoi region approximately 15km east of the town of Zarafshan on an elevated plateau, located in the Kyzylkum desert in an area largely used for rough grazing. The site required for the construction period is expected to be circa 150ha in size, reducing to 70ha when built. Once operating, it will produce enough electricity to power 500,000 households and avoid 1.1 mtpa of CO2 emissions.

The timeline from signing to completion reflects the complexities of developing a greenfield wind farm, including addressing the specificities of the site, and to comply with the development finance institutions' (DFIs') stringent E&S requirements.

Twelve months of site-specific wind measurements were performed, with four masts to accurately map out the wind resource given the site size, at a height close to the turbine hub height. The environmental and social impact has been assessed in compliance with Equator Principles as a Category A project – in particular, to carefully manage any environmental impact given significant bird nesting was identified near and on site.

To that end, a two-nesting season bird monitoring programme was put in place under the environmental and social impact assessment (ESIA) – effectively a 12-month cycle. Following its completion, Masdar chose to install the Identiflight bird collision avoidance system, which through multiple high resolution stereoscopic cameras on site and AI, allows immediate automatic shut-down of selected turbines near where a bird is detected. The system is being deployed in Central Asia for the first time, having previously been successfully used in Australia and the USA, and replaces the need for a large number of human bird spotters on site. Following finalisation of the ESIA, the DFIs’ environmental and social disclosure periods of 60 to 120 days applied ahead of board approvals, given the Category A nature of the project.

In parallel, a thorough procurement exercise was carried out with a range of EPC contractors and OEMs, with cost to performance optimisation being key, to support the aggressively low tariff agreed under the PPA. In particular, while Chinese EPC contractors have been well banked in the Middle East and several developing markets, this had not been the case for Chinese wind turbine manufacturers. Given performance-adjusted cost advantages, Masdar made the decision to proceed with Chinese OEMs.

Goldwind, perhaps together with Envision, has been the most successful Chinese turbine OEM in non-Chinese markets, notwithstanding a limited number of international references. Masdar engaged early with DFIs to ensure acceptability of Chinese OEMs, and then selected Goldwind to supply 111 GW155-4.5MW turbines (a total installed capacity of 521.7MW). Unsurprisingly, the DFIs involved were especially focused on supply chain considerations and enhanced due diligence was performed on Goldwind, which was successfully concluded.

SEPCO III, an engineering subsidiary of state-owned PowerChina, was selected as EPC contractor, per the Nur Navoi solar IPP precedent. Post-construction SEPCO III will operate the plant for two years before handing it over to MSTS, Masdar’s O&M company, with Goldwind providing a 20-year long-term service agreement.

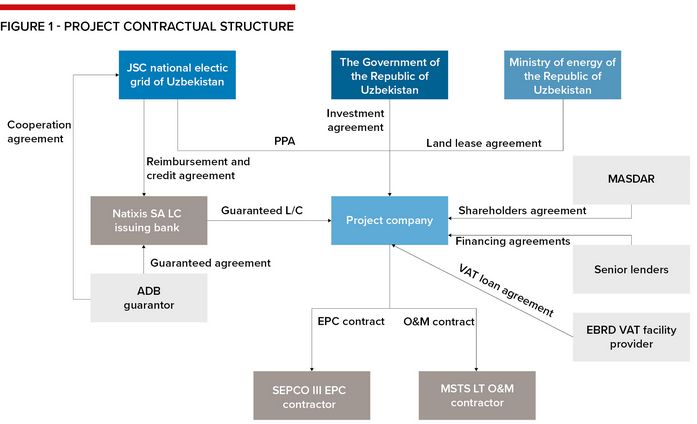

In terms of funding sources, DFIs were identified early on as providers of the longest tenors at the lowest cost. Masdar has a long track-record of working with DFIs and had funded the Nur Navoi solar IPP with IFC and ADB as senior lenders, with the EBRD providing an equity bridge loan. In this instance, a DFI parallel A-loan lending group was formed, comprising the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the International Finance Corporation (IFC) and the Japan International Cooperation Agency (JICA) – the latter able to provide enhanced pricing for renewable projects – with FMO coming in as a B loan lender. Masdar diversified its funding pool further to include an export credit agency (ECA) – Etihad Credit Insurance (ECI), the UAE export-credit agency, offered its inaugural non-recourse untied cover to the project, with Natixis and FAB acting as covered lenders.

As with other projects in the country, a short-term letter of credit provided by Natixis was put in place to enhance the offtaker credit, backed by a partial risk guarantee provided by ADB that could be drawn to cover non-payment by NEGU.

To manage the significant increase in base rates between PPA signing and financial close, as well as the high inflation environment, Masdar has adopted a proactive risk and procurement management approach, ensuring a successful close notwithstanding the macroeconomic volatility.

One innovation that this project had and was specifically needed in the Uzbek context is the provision of a VAT facility for construction costs. In the absence of any local bank solution, Masdar worked with the EBRD to develop such a facility under a revolver structure to cover construction period VAT payments – the first time a DFI had offered such a product in the country, and no doubt a constructive precedent for future transactions.

| TABLE 1 - Key dates | |

| PPA Signing | 10-Jun-20 |

| Finance Agreements Signing Ceremony | 31-Aug-22 |

| Financial Close | 10-Nov-22 |

| TABLE 2 - Advisors | |

| Sponsor Financial Advisor | Cranmore Partners |

| Sponsor International Legal Advisor | Norton Rose Fulbright |

| Sponsor Local Legal Advisor | Centil |

| Sponsor Environmental Advisor | Wood |

| Lender International Legal Advisor | Clifford Chance |

| Lender Local Legal Advisor | Grata |

| Lender Technical Advisor | UL |

| Lender Insurance Advisor | INDECS |

| Lenders Environmental and Social Advisor | RINA |

Future of PPPs in Uzbekistan

According to the New Uzbekistan Development Strategy 2022–2026 one of the key priorities for the Government of Uzbekistan is the increase of GDP growth via the expansion of private participation in the economy – one of the key solutions is the wider use of PPPs across the infrastructure and energy sectors.

In April 2022, the Government of Uzbekistan adopted a comprehensive PPP programme of more than US$15bn to implement this vision. The programme includes more than 150 different projects in various sectors, including public infrastructure, transport, water supply and sanitation, social infrastructure, and logistics, as well as energy (both conventional and renewable).

For the Uzbek government to undertake and finance such an ambitious programme – and to note that the country’s GDP as at 2021 was US$69.3bn according to the World Bank – transparent and bankable PPP legislation and regulation have been implemented with the first version of the PPP law adopted in 2019; and a new government agency under the Ministry of Finance established in 2018 – the Public–Private Partnership Development Agency (PPPDA) – which works alongside the Ministry of Finance, the Ministry of Investment and Foreign Trade, the Ministry of Economy and other line ministries.

In implementing this programme the Uzbek government will need to ensure timely introduction of further legislative acts and development of the PPP law to support new sectors such as roads, and ensure they have the required institutional capacity to manage and appropriately assess what is a relatively large number of projects.

The diverse pipeline for 2023 comprises the following projects totalling US$1.1bn in value:

* University accommodation PPP programme

* 200MW wind farm in Karakalpakstan

* Multiple schools PPP

* Tashkent waste-water treatment plant PPP

* Regional radiotherapy centres.

Beyond 2023, the government is planning two large toll road projects: the Tashkent–Samarkand Road PPP with estimated capex of about US$1.4bn and the Tashkent–Andijan Road PPP with projected capex of US$2.8bn – both of them are to be structured on a non-recourse availability payment basis.

There is a large pipeline of new transactions for the power sector. Recently, the IFC has tendered three new plants totalling 1GW of new capacity and this will be followed by a new ADB-advised solar tender, Khorezm. Of note, the IFC tender attracted only four developers to eventually bid for the three plants – a similar pattern seen in renewable tenders more widely than in Uzbekistan. In addition, the EBRD is advising on a pipeline of wind projects. Finally, ACWA Power, among others, has been bilaterally developing deals including 1.5GW of wind farms.

With this level of development activity, the 3GW wind and 5GW solar target by 2026 appears achievable. Masdar is also targeting to reach financial close on three solar plants that were tendered in the first half of 2021: the 220MW Samarkand and Jizzakh solar IPPs, and the 456MW Sherabad IPP.

The large pipeline of projects active in Uzbekistan points to a potential need for developers to more widely diversify funding sources – as was seen on this transaction through the introduction of an ECI-covered tranche. The scrutiny by funders of supply chain and forced labour themes will also be a consideration for developers of projects on their time-lines.

Zarafshan reaching financial close in a macroeconomically volatile period was due to the hard-work, flexibility and persistence of all parties involved – lenders, government and above all Masdar and the Uzbekistan Government – to make the plant and Uzbekistan’s renewable energy targets a reality. It should also provide a number of firsts in terms of financing sources and structuring that are likely to be reproduced in transactions going forward both in Uzbekistan and more widely.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email leonie.welss@lseg.com