The first non-recourse debt financing for the construction of an offshore wind farm was closed in October 2006. Fifteen years later, as the sector has moved from a marginal activity confined to the North Sea to a global industry and is now seen as a critical part of the ongoing energy transition, it is interesting to take a look back and see what has changed, and what has not, on the debt financing side. By Jérôme Guillet who was managing director of Green Giraffe until August 2021 and has been involved in offshore wind financings since 2004.

One of the most impressive features of the offshore wind project finance universe is that lenders have been willing to take construction risk from the get–go, and across all jurisdictions, turbine technologies including all latest turbine models and macro-economic contexts. This is all the more remarkable given that the sector brings together very disparate industries (turbine manufacturing and operation, towers and foundations, heavy electrical equipment, undersea cables, and marine construction, or installation of all of these) with no obvious dominant contractor to take responsibility for the whole project through an EPC contract, and projects have been built solely on a multi-contracting basis. In fact, offshore wind is the only sector where banks regularly take complex construction risk without an EPC wrap – and this has been true from the very first financings – Q7 in 2006, C–Power Phase 1 in 2007 and Belwind in 2009.

Greenfield

It was definitely a lucky break that the first two financings were done before the great financial crisis of 2008 at a time when banks were bullish, as this made relevant precedents available in the subsequent years, when banks retrenched to more conservative lending policies focusing on core countries, fewer sectors, and key clients. Offshore wind would have happened in any case as it was structurally attractive to banks: green energy, projects initially in well-rated Northern European countries, mostly strong clients as developers, but could have taken a lot longer to mature if there had been no reference transactions yet. It also helped that the early transactions were done in different countries, with different turbine models and contractors, avoiding an early focus on only certain narrow parameters for acceptable deals.

This was made possible via relatively intrusive due diligence and involvement in the design and negotiation of the commercial contracts, with a focus on limiting the number of such contracts, and understanding the interfaces between them (and associated risks) in great detail. The standards to which projects have been held have been remarkably consistent over the years, and have led to fairly recognisable features that continue to exist to this day, such as pre-agreed contingency budgets and delay mechanisms, long-term operations and maintenance agreements with availability warranties provided by the turbine manufacturers, comprehensive insurance policies, and a specific focus on guaranteeing the readiness and availability of critical installation vessels well in advance.

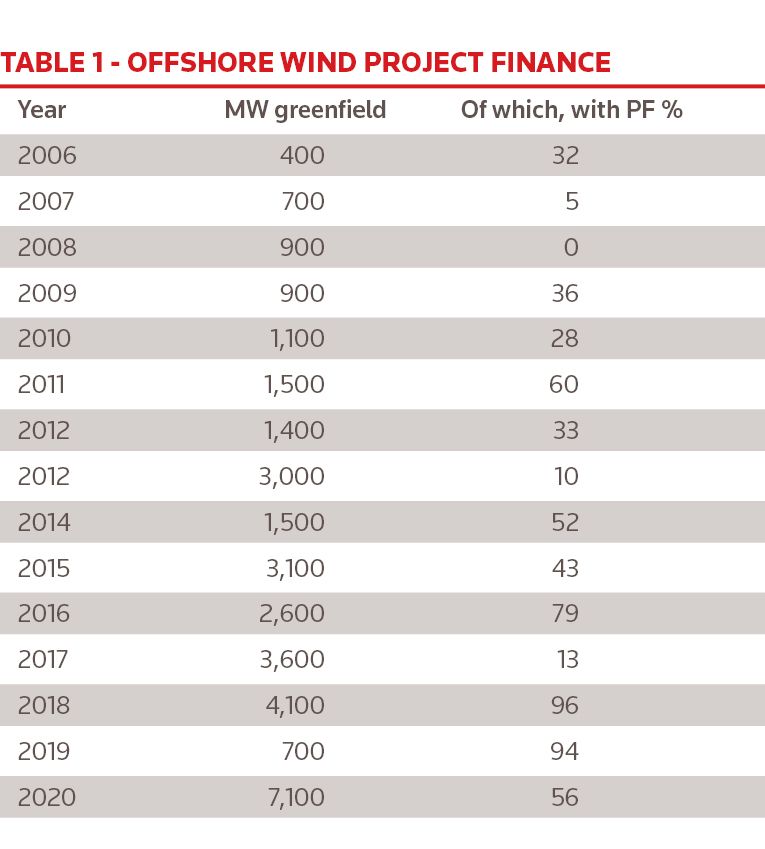

Such requirements were not acceptable to a number of project developers, in particular the early leaders among utilities, such as DONG, now Ørsted, Vattenfall or the earlier RWE, and the sector was – and has remained – split between the projects built with non-recourse debt for construction in mind, and those where construction was managed by the owners with no interference from lenders or their technical, legal or other advisers, and typically more risk kept by the projects and managed internally by the – larger – teams of such owners. In the early days, the balance sheet projects were dominant, but we are now at a stage where probably half of the projects and more in some years are built with construction finance in mind from the start see Table 1.

While the details of individual transactions are obviously confidential, these due diligence requirements mean that banks (and their technical advisers) have comprehensive information on the construction contracts – and then on the actual construction process itself – for more than half of all offshore wind projects, creating a body of experience and knowledge well beyond that of any individual project owner, even the leading utilities. With the ability to learn from previous projects and build a wealth of good practices that could be suggested – or imposed – on subsequent projects, the understanding and management of offshore wind construction risks has made continuous progress over the years and this has translated into steadily improving terms for such debt transactions: commercial items such as maturity, leverage, contingency amounts and obviously pricing have all seen a continuous trend towards more borrower-friendly terms – but in the context of due diligence and contractual standards that have remained quite firm, see Table 2.

![]()

Banks have been helped in that respect by the fact that almost every transaction has unique features – whether its soil conditions, distance to shore, size, or the accounting, tax, and commercial requirements of sponsors – that need to be reviewed and a large number of transactions included a new, bigger turbine model, and, often, new installation vessels, and these systematically require some level of confirmation that they have been designed and built to continuing high standards.

The volume of knowledge – with generally positive experiences – has helped the early pioneers make themselves comfortable with the risks they were initially worried about. Information collected over time included risks being less then feared – estimates for losses for transmission and turbine availability were initially more conservative than was ultimately necessary, for example – as well as risks actually materialising (delays by contractors, suppliers going bankrupt, grid unavailability, unfavourable weather) and project teams successfully managing to solve them within the boundaries allowed by the original financing. The quality of the project team was clearly identified as a fundamental item, and a premium was given to the teams, and individuals, who had done it before.

In that context, lenders were able to contribute actively to the massive decrease in prices in the tenders for long-term tariffs, starting in 2016, through the continuous improvement in commercial terms they agreed to, which followed their increased confidence about the management of the underlying risks.

These trends have been true across all countries where offshore wind has been financed, including most recently in France, Taiwan and the USA, and can be expected to remain consistent across all offshore wind markets, at least in advanced economies. The premium for projects in completely new jurisdictions with only limited access to the existing European supply chain and infrastructure has been quite low from the get-go – it can be expected that the early Taiwanese and US projects will require extensive involvement of the banks during construction, as did the first generation of utility-scale European projects in 2011–15, and indeed some of the Taiwanese projects have already required significant interventions. The approach to-date has been to rely on experienced sponsors and project teams to manage the inevitable problems as they appear, and it has been very successful.

It is worth pointing to the evolution of the LNG debt market, which went from exotic in the mid‑90s to mainstream 10 years later, and remember that some of the Qatargas transactions before the financial crisis ended up with pricing in the 40bp–50bp range. While offshore wind seems unlikely to go down so far given the incompressible risk linked to the unavoidable complexity of large-scale construction in a hostile environment, it reminds us that the trend for these project financings is towards increasingly sponsor-friendly terms over time – and that is a good thing for such capital-intensive projects.

A similar trajectory is highly likely for floating offshore wind project, once the first non-recourse construction financing is achieved, which had not happened as of the time of writing of this article in November 2021 – with initial projects likely to see intrusive contractual requirements and conservative debt parameters and subsequent transactions to see continuous progress towards more sponsor-friendly commercial terms.

![]()

Refinancings

In parallel to the greenfield market, a vibrant refinancing market has grown to refinance projects once they have been built, whether they were financed on balance sheet or with non-recourse debt. Lender expectations for the operation of offshore wind farms are much less stringent that for construction and most utilities and other experienced developers have been able to make themselves comfortable with the residual requirements for non-recourse finance: typically a long-term operations and maintenance contract and/or a long-term equity retention commitment by the operating sponsor, some control over unusual operating budget changes and some form of security over revenues.

This has made it possible to bring about more aggressive structures, such as “holdco” financings (debt provided to sponsor corporate entities that own only a fraction of the underlying project and thus without direct security on project assets and contracts), bond transactions, and even pre-construction financings with completion guarantees by the utility building the project. The main goal of such refinancings has naturally been to improve commercial terms for the debt: in particular leverage and pricing can be more sponsor-friendly once construction risk is gone), but they have also become a route to lock in cheap capital early on in the project cycle by making it possible for utilities to sell stakes in projects on a leveraged basis to financial investors while keeping operational control. They thus kept the full production capacity on their balance sheets without consolidating the debt but with a largely optimised capital structure from the start.

This has led to a greater variety of transactions as utilities have tapped different pools of capital, such as institutional investors (via debt funds or otherwise) or public bond markets alongside the ever-available traditional bank debt market. For larger transactions, several of these pools have been tapped on a pari passu basis.

![]()

The numbers from all past transactions suggest that all of these liquidity sources are similarly competitive, as far as maturity, pricing or other key terms are concerned, and the choice between the potential lenders often comes down to sponsor corporate, tax and accounting preferences and, often, strategy as to the subsequent sale or refinancing of the asset – a bond with an independent rating may be attractive to less experienced potential buyers, while a bank tranche is likely simpler to refinance or restructure.

The depth of this refinancing market and the ability to anticipate likely terms have made it possible for investors in projects to “bake in” improved refinancing terms in the future in their business models for offshore wind farms even before their construction, and this has in turn allowed them to bid aggressively for tariffs in various jurisdictions, on the reasonable assumption that even if the equity during construction is more expensive, they will be able to improve the capital structure of the project, and bring in cheap funding, in the future.

Even sponsors that put in place already cheap pre-construction financings with construction guarantees can expect further improvements in the future as the market keeps on delivering improved terms for risks that are perceived with increasing confidence as moderate. So even if the refinancing market does not necessarily bring new capital to the sector, it is an important part of the ecosystem as it allows the original equity investment for the construction to be underpinned by aggressive assumptions as regards the future debt terms available.

As a final point, it is worth flagging that throughout the period, there has always been enough lending capital for the sector. Transactions have never failed due to insufficient lending capacity: there was enough money for good projects, and most offshore wind projects have been structured by the industry to be definitely good enough.

Overall, offshore wind project finance is now a fully mature activity, with a wide variety of players, structures and transactions. Given the inherent complexity of construction at sea, it will never be a fully commoditised sector, with each transaction remaining almost surprisingly unique in its final features, but there is a large body of expertise and precedents that the industry can – and does – rely upon to manage risks successfully. Arguably, the discipline of project finance is one of the reasons why offshore wind has an outstanding track record, among large infrastructure sectors, in getting projects built on time and within budget.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com