SWPC’s original plan included Jubail 3 as a stand-alone IWP with a capacity of 1.2Mm3/d, but the project was later split and tendered as two separate schemes given the size. By Ali Tahir Jaffery, executive director, Project and Export Finance, AME, Standard Chartered and Sarah Kiriluk, Head of Acquisitions, Investments & Financial Advisory for Middle East, India & Africa, Engie.

The Kingdom of Saudi Arabia (KSA) is one of the largest countries in the world without any meaningful renewable water source, and has been dependent on desalinated water since the 1950s. High reliance on non-renewable groundwater sources, constituting around 35% of KSA’s water supply in 2018, coupled with one of the highest levels of per-capita water consumption and increased urbanisation is causing severe stress for the Kingdom’s water supply system. According to the Ministry of Environment, Water & Agriculture (MEWA), a demand supply gap of 4.5Mm3/d is expected by 2026 if firm policy measures are not implemented.

MEWA has accordingly set several policies and plans, including curbing the national urban water per capita requirement by encouraging demand side management, minimising network losses, and phasing out reliance on non-renewable ground sources. A directive has therefore been issued by MEWA to provide 90% of national urban supply by desalinated water by 2030 and Saudi Water Partnership Company (SWPC), which was originally established as the Water and Electricity Company (WEC), to procure new capacity, has been entrusted, among other things, to bridge the expected demand supply gap.

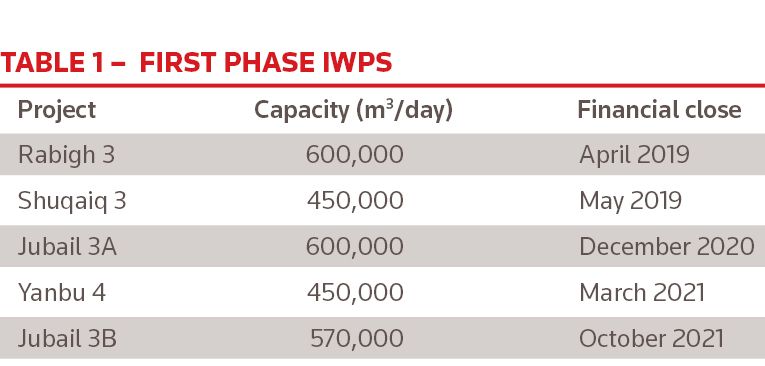

SWPC plans to set up a number of new desalination plants with active participation from the private sector under the Kingdom’s well-established privatisation programme. In the first phase, five IWPs were launched, which have all now successfully achieved financial close, see Table 1

The procurement

SWPC’s original plan included Jubail 3 as a stand-alone IWP with a capacity of 1.2Mm3/d, but the project was later split and tendered as two separate projects given the size. Jubail 3B was tendered as a greenfield IWP that will be capable of producing 570,000m3/day of potable water through reverse osmosis (RO) technology to supply the Riyadh and Qassim regions of the Kingdom. The project is located in Jubail, in the Eastern region of Saudi Arabia and approximately 65km north of the King Fahd International Airport in Dammam.

Jubail 3B follows the established SWPC framework, including:

* Structured with a 25-year concession commencing from the project commercial operation date based on an availability-based tariff structure;

* 100% ownership of the project company by the private developer(s) with no government shareholding;

* Credit support provided by the Ministry of Finance covering all payments due under the water purchase agreement, the SWPC credit support; and

* Development of certain electrical special facilities including a sub-station and overhead lines connecting to the grid, which are to be transferred to National Grid SA ahead of the project commercial operation date.

![]()

SWPC is also making a clear shift to more energy-efficient initiatives for cleaner desalination solutions in line with Kingdom’s Vision 2030. Not only is the shift to reverse osmosis considered to be more energy-efficient than traditional thermal desalination technologies, but the use of renewable energy instead of traditional fossil fuels in the recent desalination projects further reduces the carbon intensity of the technology compared with traditional technologies.

Jubail 3B also includes the use of on-site solar power for up to 20% of the plant’s specific power consumption. This provides a number of benefits including reducing reliance on the grid, reducing costs and improving overall environmental performance. The financing for the project has accordingly been certified as green financing by S&P Global.

SWPC pre-qualified 10 developers to participate in the tender for the Jubail 3A and the Jubail 3B IWP projects on August 5 2019. The successful bidder for Jubail 3A was announced in March 2020 and in order to avoid concentration risk, the successful bidder for Jubail 3A was precluded from bidding for Jubail 3B. While the original bid submission date was set as May 17, it had to be extended a number of times to give bidders more time due to Covid-19 related travel and other restrictions.

A total of four bids were received by November 1 2020 and, following a detailed evaluation and clarification process, on April 29 2021 a consortium of Engie, NESMA and Al Ajlan was declared the preferred bidder with a tariff of SR1.591 halalas per cubic metre of potable water. The consortium of Aqualia, Haaco and Alfanar came in second with a tariff of SR1.605 halalas.

Shareholding

Jubail 3B will be implemented through a standalone special purpose vehicle, Al Jubail International Water Company. The SPV is owned 40% by Engie, 30% by NESMA, and balance of 30% by Al-Ajlan.

* Engie – One of the largest integrated electricity and gas groups globally generating, with dominant market shares in its historical markets (Belgium and France) as well as leadership positions in several power, gas and services segments. Engie has global operations in 70 countries and its developments have included the management, design, procurement, construction and operation and maintenance of 1,225 MIGD gross of desalinated water capacity with over 15 plants and 30GW of power in the form of I(W)PP projects in the GCC alone.

* NESMA – Privately owned Saudi Arabian company that maintains a diversified business portfolio in Saudi Arabia, Dubai, Egypt and Turkey. NESMA was established in 1979 and has a long track record of establishing joint ventures and partnerships with international companies.

* Al-Ajlan – Saudi Arabia-based conglomerate that operates in varied sectors such as construction, real estate and clothing and has recently set-up a separate division to focus on the power and water sectors.

Financing plan

The total project cost of US$704m is being financed by senior project finance debt and equity in a 76:24 ratio. The sponsors are to provide the entire base equity upfront prior to the drawdown of debt in the form of equity bridge loans (EBLs). The financing plan allows the EBLs to be extended until five years post commercial operation date.

The total senior debt amounting to approximately US$538m has been sized on the basis of a minimum DSCR of 1.2x and with a contractual door-to-door tenor of a little over 27 years. The facility has been structured on a soft mini-perm basis with a pricing step-up and a cash-sweep mechanism to incentivise refinancing once the construction risk falls away.

Under the proposed structure, a failure by the project to refinance the debt by commercial operations date (COD) plus five years means a mandatory cash sweep will be triggered to ensure that the facilities are fully amortised at least 3.5 years prior to the contractual final maturity date. Such a structure has become common-place for similar financings in the region.

The financing is expected to be sourced from a mix of international and regional banks, with five banks including MUFG, Norinchukin Bank, Riyad Bank, SMBC, and Standard Chartered providing the commercial facility and SNB being the only Islamic lender. Standard Chartered acted as the lead documentation bank for the financing while MUFG is acting as the intercreditor agent.

![]()

Contractors

The project will be constructed by a consortium formed by Acciona Agua SA (Spain), SEPCO III Electric Power Construction Co Ltd (China) and Power Construction Corporation of China (China). Operations and maintenance (O&M) services will be provided by Engie Al Jubail O&M Water Company, fully owned by Engie, under a long-term O&M contract.

Challenges

The Saudi PPP and project finance market is currently one of the most active anywhere in the world, and while the project follows an extremely well-established framework, it too has had to face certain challenges:

* Covid-19 – The Covid-19 pandemic and the ensuing turmoil in the markets, albeit short-term, had an impact on the regional project financing market as well, including delays in procurements and implementation plans, increase in margins, and tightening of terms. Accordingly, the Jubail 3B bid submission date had to be extended several times.

* Protracted evaluation process – While four bids were received by SWPC by November 1 2020, it wasn’t until six months later, on April 29 2021, that the preferred bidder was finally announced. The evaluation process included detailed clarification from all four bidders, but eventually the tariffs of only two bidders were announced, suggesting that the remaining two were non-compliant

* Insurance markets – The insurance market has seen a significant hardening of terms owing to natural disasters such as hurricanes across the Americas and other natural calamities, including flooding and wildfires in many parts of the world. The advent of Covid-19 has compounded these challenges with estimates suggesting incremental costs of US$220bn added to the insurance market due to the global pandemic. Insurers have started to try and recoup losses by increasing premiums and reducing the coverage or increasing deductibles. The project was nevertheless able to procure a bankable insurance programme on the back of the track record in KSA and appropriate overall risk allocation.

* Localisation requirements – The water purchase agreement included significant requirements for local content and Saudisation obligations, and liquidated damages for failure to meet such targets.

* Regulatory regime – The Saudi PPP market has undergone several regulatory reforms and other general legal developments. The implementation of the project had to account for the changing environment in respect of updates to the environmental and social processes, VAT rates, and the customs duties regime.

SWPC’s future plans

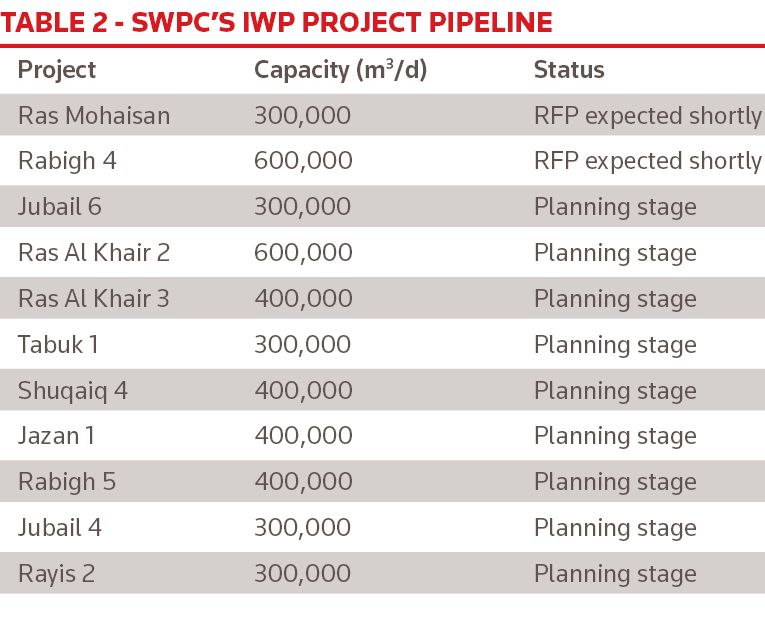

SWPC has set itself an initial target of boosting its current desalination capacity from 5.1M m3/d to 13.6M m3/d by 2026. It will therefore continue to focus on procuring new RO-based desalination plants and has accordingly announced a number of desalination projects to be constructed in order to bridge the estimated demand supply gap, see Table 2.

SWPC is committed to KSA’s waste-water treatment and re-use objectives under its Vision 2030 plan. The goal is therefore not only to increase network coverage in the Kingdom but also to boost the waste-water collected and treated using sewage treatment plants (STPs) throughout the Kingdom. While SWPC’s primary focus is on large STP plants that would not only benefit from economies of scale but also be attractive to the private sector and feasible for project financing, a large number of small scale projects – 1,000m3/d up to 25,000m3/d – will also be set up.

![]()

In addition to water production facilities, SWPC also aims to develop water transmission and strategic storage facilities to strengthen the resilience of the sector against demand spikes or supply shortfalls. To that end, sector policies set a strategic storage target for 2022 equivalent to three days of municipal water demand. In addition to their emergency role, strategic water storage facilities will be used for peak load management of Hajj water demand, which takes places in a span of approximately 20 days in Makkah and 40 days in Madinah, resulting in a considerable short-term peak demand water.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@lseg.com