International investors are worrying about China more than ever. But slowing growth and weak corporate earnings don’t seem to concern mainland shareholders, who have pushed up domestic stocks by more than a fifth since the end of September. It’s a reminder than when it comes to equities, the Chinese market dances to its own tune.

It’s hard to find many positive economic signs in China. Exports fell for the fourth consecutive month in October. Manufacturing is contracting, and sentiment in the services sector is cooling. Though bureaucrats insist the economy will grow by at least 6.5 percent a year until 2020, this seems a stretch without significant stimulus. The corporate sector is feeling the strain: the third-quarter earnings of Chinese companies with A-share listings fell 13 percent year on year, according to analysts at Macquarie.

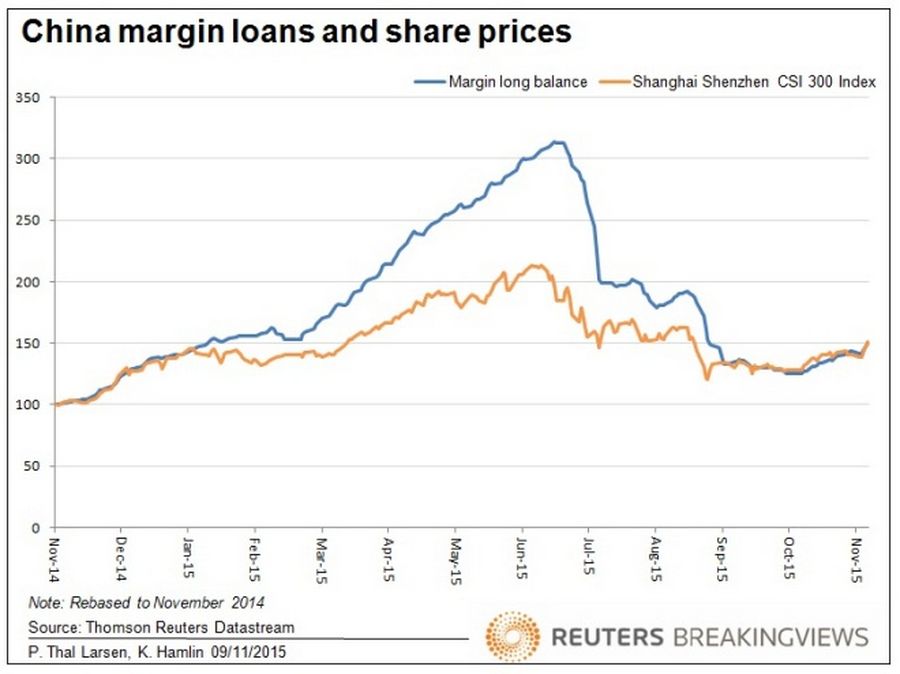

Yet in the stock market, the mood is picking up after the crash of the summer. The benchmark CSI300 index has risen by more than 20 percent since the end of September. A revival in margin lending may be helping: official balances of loans used to buy shares recently rose above 1 trillion yuan ($157 billion), suggesting that painful memories of the dangers of leveraged investing are already fading.

Reforms to the process for initial public offerings are another factor. China’s securities regulator on Nov. 6 said it had lifted the ban on new offerings imposed in July. Under the new system, investors will no longer have to put up all the cash for shares they have ordered in an IPO. That matters, because oversubscribed Chinese offerings tend to suck cash out of the market. In June, investors tied up 5.69 trillion yuan bidding for shares of 25 companies worth just 41.4 billion yuan, according to China’s Securities Regulatory Commission.

Such reforms suggest that Chinese authorities have learned some lessons from the most recent bubble. But the recent revival is limited to China: the gap between the value of mainland shares and their Hong Kong-listed equivalents is at its widest in two months. Unless corporate results dramatically improve, mainland investors will be disappointed again.