China left the cloistered safety of its dollar peg exactly ten years ago, on July 21, 2005. It was a major step on the journey toward global economic preeminence, and a clear endorsement of market forces. That was then.

At the most obvious level, the change has been a big success. The 53 percent increase in the yuan’s real effective exchange rate against trading partners’ currencies since July 2005 has given imports a real boost. Outsized Chinese current account surpluses, the much-maligned symbol of China enriching itself by pushing the West into debt, have become a thing of the past.

Although the authorities still guide the exchange rate, the International Monetary Fund has signed off that the yuan’s value is currently fair. Last year’s trade surplus was only 2.1 percent of GDP, below the euro zone’s 2.4 percent. Beijing is not done. Its ultimate goal is to eclipse the U.S. dollar in global trade and currency markets.

However, the ruling Communist Party is still uneasy with financial markets, as the heavy-handed efforts to restrain the recent equity selloff made clear. More ominously, as the trade imbalance has fallen, the domestic financial system has become increasingly unbalanced. In the last decade, private debt has more than quintupled. It’s now twice as high as GDP.

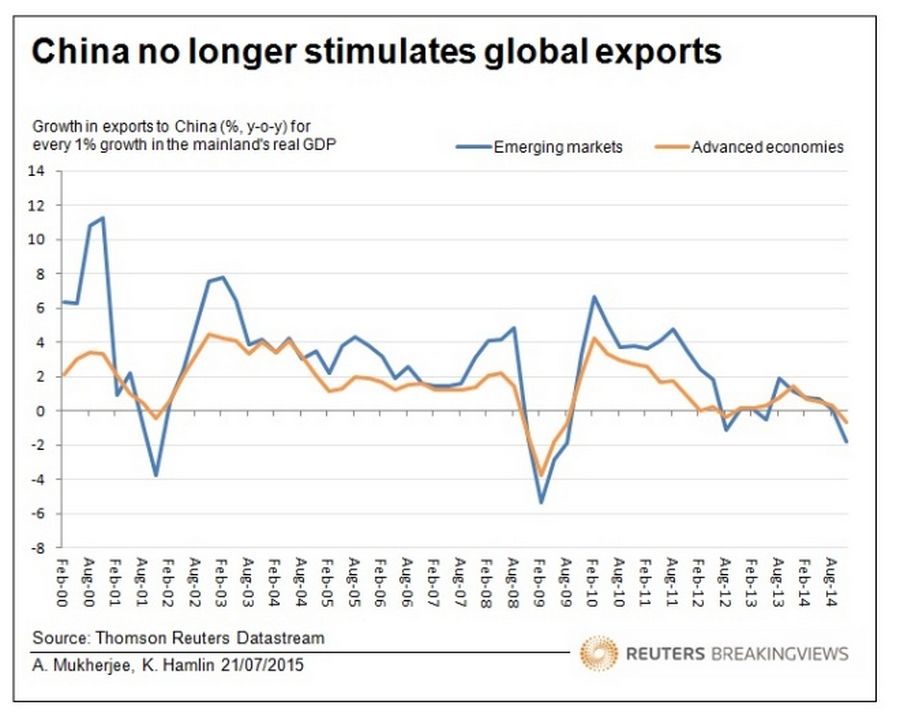

The domestic debt overhang increases the danger from overinvestment in export industries, a trend which encouraged the authorities to adopt a more flexible yuan in the first place. The problem could quickly become acute. The country’s productivity growth has waned and the 7 percent pace of GDP growth is no longer stimulating exports by the rest of the world. If all goes wrong, the future Alibabas and Tencents will end up starved of funds, while overcapacity-plagued sectors like steel and property drown in debt.

China’s global aspirations will be at risk, too. For initiatives like the “One Belt, One Road” trade network, and financing arrangements like the Asian Infrastructure Investment Bank to have any heft, China needs to strengthen its growth muscles by allocating capital more efficiently. That’s what the next 10 years have to be about.