China’s economy is growing at its slowest rate in six years. Yet the Shanghai stock market is at seven-year highs. The disconnect seems strange, but is not unusual. Until equity starts to play a bigger role in financing Chinese business, the link between share prices and the broader economy will remain hard to discern.

Though first quarter GDP growth of 7 percent was in line with the government’s target, China’s economy is clearly slowing. Take real estate: the floor space of residential developments started in the quarter was a fifth lower than in the same period of 2014. Industrial production, investment and retail sales were all weaker in March.

Yet investors seem unbothered. Though shares dipped slightly after GDP data were released on the morning of April 15, the Shanghai index is up almost 70 percent since early November. The euphoria has spilled over to Hong Kong, where mainland investors have helped push up the stock market by more than a tenth in just over two weeks.

For some, the decoupling is further evidence that Chinese stocks are in bubble territory. In fact, the country’s shares have a long tradition of defying economic fundamentals. Between 2010 and 2013, when China grew at a steady rate, the Shanghai index lost more than a third of its value.

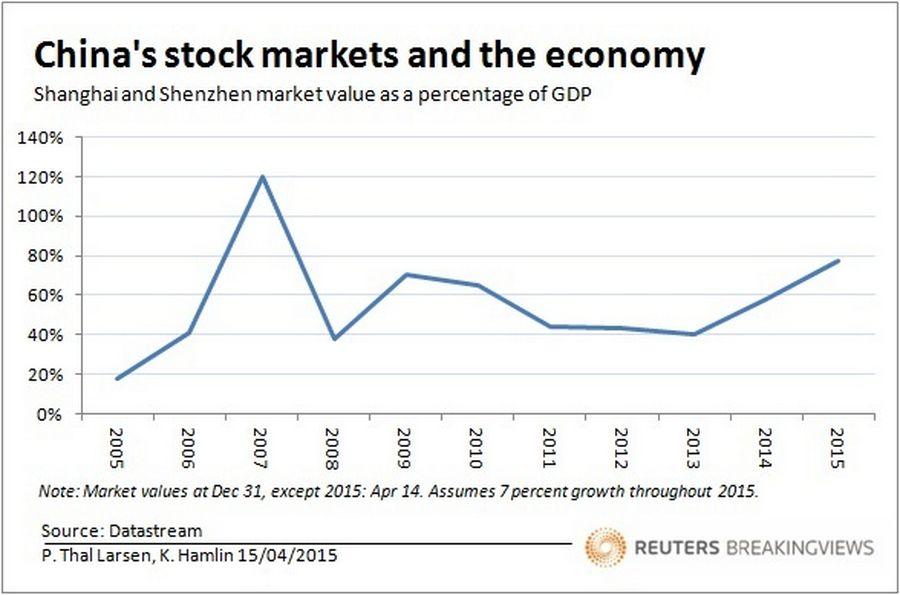

Part of the reason is that equity plays a much smaller role than debt in funding economic activity. Over the past five years, shares issued by non-financial companies accounted for less than 2.5 percent of total social financing – China’s broad measure of fundraising. Even after the recent rally, the Shanghai and Shenzhen stock markets combined are worth less than 80 percent of Chinese GDP. In the United States, the combined worth of the Nasdaq and NYSE is almost 160 percent of annual output.

China’s slowdown could make it more difficult for companies to access cheap debt, and force them to think more carefully about return on investment. That might be good for equities. But such a shift is still some way off. In the meantime, anyone hoping to use the stock market as a proxy for China’s economy is likely to be frustrated.