The Refinitiv project finance numbers for the first half of this year show an encouraging increase in activity in the market, but underpinning the numbers the tectonic plates have been shifting, quickly. LNG is back on the gas, fibre is covering the land and the push to net zero via renewable energy has slowed a little. Underlining all this is a changing economic and capital markets environment that does not bode too well – in the short term.

It is a time of flux. The watershed moment came just into the new year. Two project bond issues in the Gulf did not fly out of the door as expected and the cat was out of the bag – the debt capital markets had hit a wall. This is a particular problem in the Gulf, where many construction projects over the last few years were funded on a soft or even hard mini-perm basis with a refinancing expected in the capital markets. Not so into 2022. The next refinancing in the Gulf, the Mirfa water and power project, will be funded in the bank not the bond market.

The Russian invasion of Ukraine then put the spotlight further on global inflationary economic woes, as did more Covid lockdowns in China. But the basic problem was the debt overhang from the last two years when a lot of money was printed and economic activity fell – a definition of an inflationary accelerator. It was coming, whatever.

In the project finance world commercial loan banks are still taking up the slack. The NeuConnect interconnector deal got 20 banks last week. But will the loan banks follow the bond and high yield markets into hibernation? That would be logical to some extent. In addition, the emerging markets, where project finance is a valuable financing source, are suffering from a rising dollar as US interest rates climb. One example is India, a market that was taking off last year with new dollar debt coming in, and is now taking a pause with volumes this year down 50%.

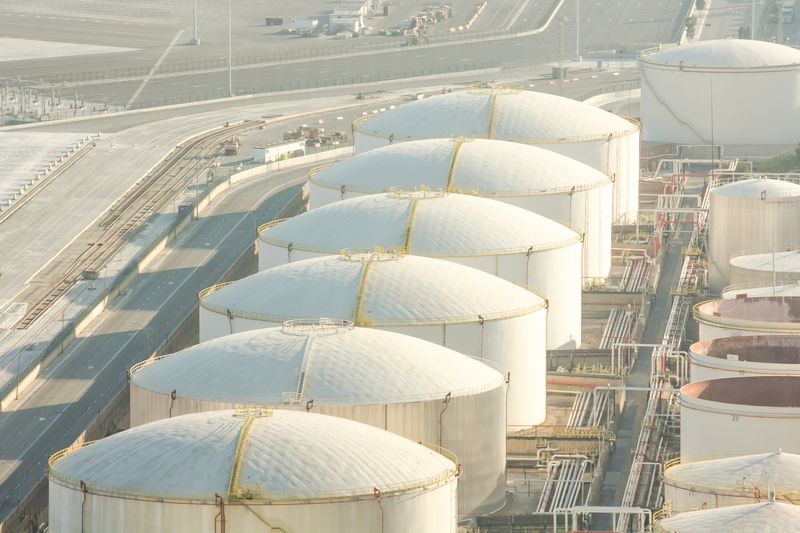

It's an ill wind that blows no good. The depressing events in Ukraine have put the spotlight firmly on the LNG market once again. Ironically, the last large-scale LNG deal to be financed before the invasion was the Arctic LNG 2 scheme in Russia. Now the focus in squarely on finding gas outside Russia – mainly in the USA, which, according the Energy Information Administration (EIA), was the top global exporter of LNG in the first half of this year.

That feat has been achieved from existing resources. Despite the fact that inflation is hitting many new projects, with renewables in particular suffering from higher construction prices, the new dash for gas is such that sponsors are pushing ahead quickly with new LNG build schemes. Indeed, in the first half of this year US$23bn of project finance was raised in the sector – mainly in the US but additionally in Australia.

If you have a permit to build an LNG scheme in the US right now, the debt is there to fund it. What is more, the struggle to get long-term contracted buyers, a feature of the market over the last decade, appears to be over for time being. ESG-minded banks can still play but they will closely analyse how the gas is extracted.

Presumably, we can expect more schemes to come to market. Nigeria would be well-placed to supply Europe and there is now talk of a new train eight for Nigeria LNG. With train seven under construction a train eight would send capacity up to 38mtpa. Of course, the Qataris are already boosting their capacity to 126mtpa. Elsewhere, work in Papua new Guinea is speeding up and there are the large-scale projects in East Africa – Mozambique and Tanzania.

If oil and gas, and LNG in particular, has been a staple in the project finance market, telecoms is a new kid on the block. Loan volumes have jumped from US$8.2bn this time last year to US$33.1bn this year. In Europe, volumes are up from US$7.8bn to US$26.9bn. That is an awful lot of fibre being laid around the place, assets that can only benefit the wider community – unless you believe the intervention of the internet was not such a great thing after all! In the UK, the market will decide on the corporate winners while in the rest of Europe, competition is more managed.

This leaves the renewables space. The boom led by offshore wind has tailed off slightly but there should be some decent size deals done in the second half. Green financings totalled US$36.1bn in the first half, down from US$41.1bn this time last year, with solar making up nearly half at US$19.8bn and wind US$8.6bn. Grid access and decent supply chains are the bigger long-term issue.