Hybrid renewable technology is in the spotlight as an emerging new renewable energy system that can play a key role in accelerating India’s energy transition. Adani Green Energy Ltd’s landmark US$1.35bn project financing of its 1,690MW hybrid renewables project in March 2021 heralds a new stage of development for India’s fast-growing renewables sector. By Jean Monson and Bertrand Ma, MUFG Bank.

The US$1.35bn construction facility, which reached financial close in March 2021, achieves multiple firsts in the market – it is the first and largest hybrid renewable portfolio project to achieve financial close in India, and one of the largest globally. It is the largest renewables syndicated external commercial borrowing (ECB) project financing in India. In ESG markets, it sets a new record as the largest green certified hybrid project loan.

Fast-growing renewable sector

As the pace of the energy transition accelerates globally, India’s renewables transformation has been quietly taking hold. The Indian government, led by Prime Minister Narendra Modi, has set itself ambitious targets of achieving 175GW renewable energy capacity by 2022, including 100GW of solar and 60GW of wind, with other renewable sources making up the balance, and 450GW by 2030. Despite making significant strides in adding renewables capacity, there is more work to be done. To meet its aggressive decarbonisation goals, India needs to find more ways to ramp up its renewables pace.

Emergence of hybrid technology

One such solution comes in the form of hybrid renewable technology. A hybrid system combines a single renewable resource (for example wind or solar), with an additional resource and/or storage element. At its simplest, and in the case of the Adani Green Energy transaction, a single power project integrates wind and solar elements to produce both solar and wind power concurrently. This can produce several benefits over single-source energy generation.

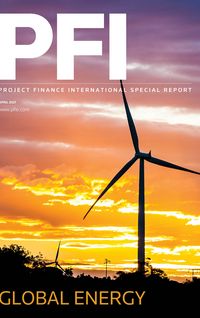

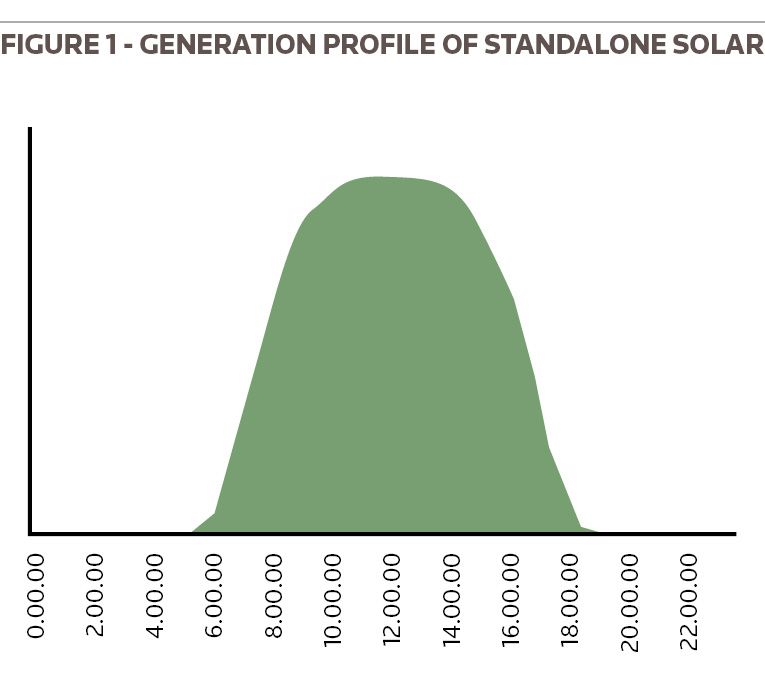

One of the oft-quoted challenges of renewable energy – by virtue of its being resource dependent – is intermittency: energy can only be produced when the sun is shining, or the wind is blowing. On a standalone basis, solar or wind power projects are only able to harness solar and wind to generate power on an intermittent, or variable, basis. A hybrid reduces this variability. Solar and wind are the perfect marriage – they have complementary generation profiles; solar power peaks during the daytime, and wind power at night.

Another sub-optimal feature of standalone solar and wind is their low capacity utilisation factors (CUFs). Power purchase agreements (PPAs) in India typically require minimum CUF levels of 20%–25% for solar, and 25%–30% for onshore wind.1 These levels are unsurprisingly lower compared with traditional thermal and base-load capacity. Enabled by the lower variability from combining the resources, hybrid PPAs require higher minimum CUF levels of 35%–50%, although this is usually accompanied by a certain level of oversizing, ie where the installed capacity exceeds contracted PPA capacity. These levels can increase further with the addition of an element of storage.

Another benefit of hybrid systems over standalone renewables is the optimal utilisation of land resources (particularly where both resources are situated at the same location) and transmission infrastructure. In each solar or wind project, at (generally speaking) 20%–30% CUF levels, the transmission infrastructure remains severely under-utilised. Reduction of variability in generation also reduces undesirable power peaks and troughs, enhancing grid stability.

The generation profiles of standalone solar and wind, compared with an integrated solar-wind hybrid profile, is demonstrated in Figures 1, 2 and 3.

![]()

In addition to complementary generation profiles on an hourly basis, integrated solar-wind hybrid projects also have complementary profiles on a seasonal basis, shown in Figure 4.

![]()

Hybrids regulatory landscape and policy

Renewable hybrid technology can be a viable solution to optimising resources and producing round the clock clean power. In May 2018, to promote the adoption of hybrid technology, the MNRE announced its National Wind-Solar Hybrid Policy. Several states – Gujarat, Andhra Pradesh and Rajasthan – followed suit with their own policies to supplement the regulatory framework. To qualify as a hybrid project under the policy, one component – either wind or solar – is required to have installed capacity equal to at least 25% of the project capacity of the other component being commissioned. Under these tenders the developer must maintain a higher annual CUF requirement; usually around 35%, but it can be as high as 80% if there is an element of storage added.

Since the introduction of the Wind-Solar Hybrid Policy, SECI has issued various tenders for wind-solar hybrids. AGEL emerged as a winner in the first two tenders, in June 2018 and March 2019, held by SECI, being allocated 390MW and 600MW respectively (part of this transaction). AGEL has since been awarded further hybrid projects under subsequent tenders, unrelated to this transaction.

Since then, different forms of hybridisation beyond blending wind and solar have started to emerge: recent hybrid tenders have included storage components (which can take the form of battery or pumped hydro) and, most recently, round-the-clock (RTC) tenders. The objective of including storage – the concept of storing energy during low demand periods and releasing it into the grid during peak demand – or even gas or hydro is to enhance CUFs so the project can come close to producing clean energy throughout the day, mimicking baseload capacity.

In the first RTC tender in 2019, annual minimum CUF requirements were as high as a minimum 80% annually and 70% monthly. However, these are still in their infancy of development and not without challenges: costs of storage remain prohibitively high and, combined with competitive tariffs, it is unclear whether developers will be able to make the economics work. The high minimum PPA CUF requirements will also need a large element of oversizing to ensure they are met.

Transaction overview and financing

The AGEL transaction comprises three individual greenfield hybrid, wind and solar, renewable projects with a combined contracted capacity of 1.69GW in the Jaisalmer district in the state of Rajasthan, India. Two projects, 390MW and 600MW, have 25-year PPAs with the Solar Energy Corporation of India (SECI). The third project has a 25-year PPA with Adani Electricity Mumbai Ltd (AEML), a private integrated utility founded in 1926, engaged in power generation, transmission and distribution (GTD) in Mumbai.

The projects have designed installed capacity above the contracted capacity in order to meet the high generation requirements under the hybrid PPAs. Together, when constructed, the transaction will represent the largest hybrid project in India by installed capacity.

Underpinning the transaction was a financing framework that AGEL and the 12 international banks, the original financiers, entered into. This framework is an arrangement between AGEL and the original financiers to help structure financing requirements for future projects, by recycling capital through innovative market solutions in support of AGEL’s ambitious goal of a 25GW renewables portfolio by 2025. The Transaction was the first to be financed under this broader financing framework.

Given the size of the projects and complexity of the technology, technical due diligence was a key focus area in the execution phase. There were a number of challenging technical aspects of the transaction. First, hybrid renewable energy is still an emerging technology and there are few constructed projects globally utilising this technology. None of the original financiers had financed a hybrid project in India – not to mention on this scale – so a thorough due diligence process was of critical importance, and a minimum requirement for each lender. A level of due diligence exceeding the familiar grounds of a standalone solar or wind system was expected by all lenders.

In the background of this intensive due diligence, inside India and globally, the Covid-19 pandemic was raging and disrupting the world as we knew it. Needless to say, this had an impact on several areas of the project, including the project schedules, supply chain, site visits etc. Consistent with projects all over the world that were being developed or under construction over the COVID-19 period, lenders alike on such projects were faced with shifting construction schedules, potential delays and uncertainty due to an unknown virus that was wreaking havoc in all aspects of our lives.

As the technical bank for the transaction, MUFG coordinated an intensive due diligence effort involving the sponsors, the original financiers and a network of technical advisers and energy yield consultants. For a number of banks, this was their first project finance transaction in the Indian renewables sector. MUFG was co-green loan coordinator.

While there have been other green renewable project loans in the market, most notably SoftBank’s 600MW solar PV farm and Engie and TTL Energy’s 100MW solar PV farm in Malaysia, this transaction represents the largest green hybrid project loan in India. It was certified using guidelines aligned with the LMA/APLMA Green Loan Principles 2021, a globally-recognised framework designed for participants in the sustainable finance market to consistently certify, track and monitor the environmental impact of financing assets. The requirements under the Green Loan Principles include controls under (1) the use of proceeds; (2) the process for project evaluation and selection; (3) management of proceeds; and (4) reporting. KPMG Assurance and Consulting Services LLP (KPMG) provided the independent limited assurance for the green loan.

Conclusion

Hybrid renewable technology is an exciting development for India and renewables globally. AGEL and this transaction achieve a landmark for the Indian renewables market, signifying the coming of age for hybrid renewable energy.

MUFG Bank acted as the mandated lead arranger, bookrunner (MLAB), technical bank, co-green loan coordinator, agency bank and hedging bank in the financing. Other lenders include Barclays Bank PLC, BNP Paribas, Coöperatieve Rabobank U.A., DBS Bank Ltd., Deutsche Bank AG, Intesa Sanpaolo S.p.A, Mizuho Bank, Ltd., Siemens Bank GmbH and ING Bank N.V., Standard Chartered Bank, and Sumitomo Mitsui Banking Corporation. Latham & Watkins LLP and Luthra & Luthra were the borrower’s counsels. Lenders’ counsels were Linklaters Singapore Pte. Ltd. and Cyril Amarchand Mangaldass.

Footnote

1 - This is a general statement based on observed PPAs. Actual CUF levels will vary widely depending on a number of factors including (but not limited to) location, seasonality, project specifications, and type of technology employed.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com